Against the backdrop of escalating global plastic pollution regulations and the booming takeaway economy, the paper lunch box machine industry is experiencing unprecedented growth and technological transformation. As countries strengthen their commitments to plastic reduction initiatives, the demand for eco-friendly packaging solutions has surged, propelling innovations in paper lunch box manufacturing equipment. This report explores the key trends shaping the global paper lunch box machine market in 2025, from policy-driven demand to technological breakthroughs and regional market dynamics.

Policy Catalysts

Governmental regulations worldwide have become the primary driver for the adoption of paper lunch box machinery. The European Union continues to lead with its ambitious circular economy strategies, requiring all plastic packaging to be recyclable or reusable by 2030 and mandating increasing recycled content percentages—with PET bottles needing 25% recycled material by 2025 and 30% by 2030 . This regulatory pressure has created a urgent need for alternatives, directly benefiting the paper packaging equipment sector.

In Asia, Indonesia's 2025 ban on plastic waste imports and its plan to phase out single-use plastics by 2029 have significantly boosted local demand for paper lunch box production lines . Similarly, China's "14th Five-Year Plan for Plastic Pollution Control" mandates a 30% reduction in non-degradable plastics in food delivery services by 2025, driving its domestic paper lunch box machine market to an estimated 4.5 billion yuan (approximately $620 million) by 2025 with a compound annual growth rate (CAGR) of 15-18% .

North America is also intensifying its efforts, with the U.S. EPA's National Strategy to Prevent Plastic Pollution encouraging federal agencies to prioritize plastic alternatives. California's SB-1053, which bans single-use plastic bags from 2026 while allowing recycled paper bags with at least 50% post-consumer content, represents a major opportunity for paper packaging equipment manufacturers . These diverse regulatory landscapes are creating both regional-specific demands and global standardization pressures for paper lunch box machinery.

Technological Innovations

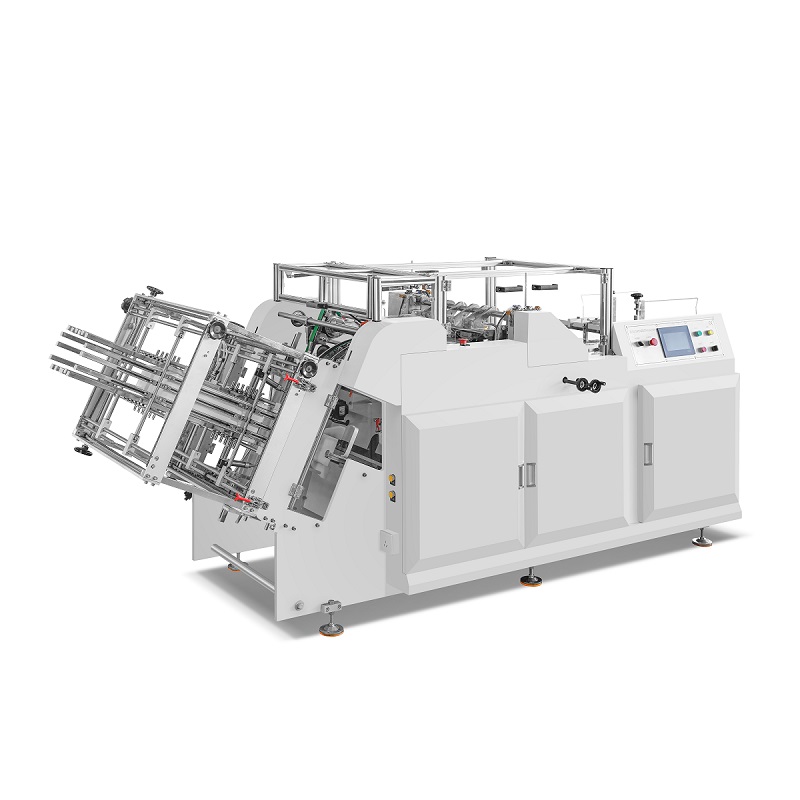

The paper lunch box machine industry is undergoing rapid technological advancement, driven by the dual needs of efficiency and environmental performance. Chinese manufacturers are leading the charge in automation, with top-tier ten-station automatic models now achieving production speeds of 1,200 pieces per minute—40% higher than traditional equipment . This leap in productivity is complemented by AI-powered defect detection systems that maintain product qualification rates above 99.2% .

Material innovation is another key focus area, particularly regarding sustainable coatings. Traditional polyethylene (PE) linings, which undermined the environmental benefits of paper packaging, are being replaced by advanced water-based functional coatings. These innovations offer superior performance: recent tests showed these coatings withstood 100℃ boiling water for over two hours without leakage and resisted 100℃ cooking oil penetration—addressing longstanding limitations of paper packaging .

Energy efficiency and resource optimization are also shaping machine design. Modern equipment incorporates modular designs that reduce format changeover times to under 15 minutes, while lightweighting technologies have reduced material consumption per container by 13% . Chinese manufacturers have made significant strides in core component localization, with servo motor replacement rates rising from 32% in 2020 to 51% in 2022, improving profit margins and reducing reliance on imported parts.

Regional Market Dynamics

The global paper lunch box machine market exhibits distinct regional characteristics, with Asia Pacific emerging as the fastest-growing segment. China's market alone is projected to reach 1.86 billion yuan (approximately $256 million) by 2025, fueled by the country's massive food delivery sector which is expected to generate 35 billion orders annually . The regional breakdown within China reveals a "quality improvement in the east, volume growth in the central, and breakthrough in the northeast" pattern, with the southwest region's market share projected to reach 18.7% by 2025 .

Beyond China, Southeast Asia presents significant potential, with Vietnam and Indonesia benefiting from reduced import tariffs (as low as 5%) on paper processing equipment . This, combined with local plastic bans, is creating a fertile market for mid-range machines priced between $80,000-$130,000.

Europe maintains a focus on high-end, customized solutions that meet strict EU standards for food contact materials. German manufacturers, in particular, emphasize precision engineering and energy efficiency, though Chinese companies are gaining ground with equipment that reduces energy consumption by 18% compared to European counterparts . North American demand is driven by both regulatory compliance and consumer preference for sustainable packaging, with a growing emphasis on machines capable of handling recycled and specialty papers.

Future Outlook

Looking ahead, the paper lunch box machine industry is poised for further integration of smart technologies. By 2025, intelligent models with environmental monitoring capabilities are expected to account for 45% of the market, enabling real-time optimization of production parameters and energy usage . The Internet of Things (IoT) is also playing an increasing role, with connected machines providing predictive maintenance alerts and performance analytics.

Market expansion will be driven by emerging applications beyond traditional food delivery. The freeze-dried food sector is already seeing 28% annual growth in equipment demand, while customized medical packaging solutions have created a $44 million market in China alone . These niche applications are pushing manufacturers to develop more versatile machines capable of handling diverse paper grades and forming complexities.

Global supply chains are also evolving, with regional production hubs becoming more prominent. Chinese paper box machine manufacturers are establishing overseas R&D centers, such as Yutong Technology's facility in Vietnam set to open in late 2024, targeting ASEAN markets . Meanwhile, European and North American companies are seeking partnerships with Asian equipment makers to incorporate cost-effective innovations into their product lines.

As the world transitions toward circular economy models, paper lunch box machines will play an increasingly critical role in enabling sustainable packaging ecosystems. Manufacturers that can balance speed, efficiency, material innovation, and regulatory compliance will be best positioned to capitalize on this growing global demand. For businesses across the packaging value chain, staying abreast of these technological and market trends will be essential to maintaining competitiveness in an era of environmental urgency.